Some Ideas on Offshore Account You Should Know

Table of ContentsLittle Known Facts About Offshore Account.Top Guidelines Of Offshore Account7 Simple Techniques For Offshore AccountOffshore Account Fundamentals Explained

2 common misconceptions regarding offshore banking are that it is unlawful which it is just for the super-wealthy. Well, it's not quite so. As an expat you can use overseas financial legitimately and also to your benefit. This guide will show you exactly how. To start with, financial offshore in a country various other than the one in which you presently live is definitely legal and reputable.An overseas checking account is commonly made use of by those who have little belief in their regional financial market or economic situation, those who live in a much less politically stable nation, those who can properly avoid tax in their brand-new country by not paying funds to it, and deportees that desire one centralised checking account source for their global financial needs.

Maintaining a checking account in a nation of residence makes significant and long-lasting sense for numerous expatriates. Unless you're trying to alter your country of residence and also sever all connections with your residence nation forever, keeping a banking presence there will mean that if ever you wish to repatriate, the course will be smoother for you.

Your company might require you have such an account right into which your income can be paid each month. You might additionally require such an account to have utilities attached to your new residential property, to obtain a mobile phone, rent out a home, increase a home mortgage or purchase a cars and truck.

See This Report about Offshore Account

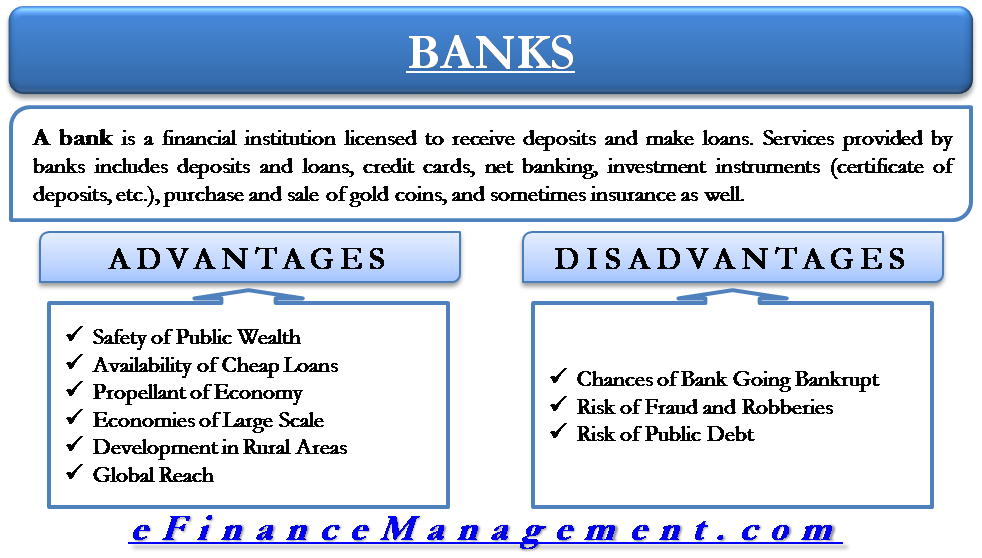

The important things to bear in mind is that overseas banking isn't always a best service for every deportee. It is very important to recognize what benefits and disadvantages overseas banking has and just how it fits in your personal circumstance. To assist you decide whether an overseas checking account is appropriate for you, below are one of the most prominent benefits and also negative aspects of offshore financial.

If the country in which you live has a much less than beneficial economic environment, by keeping your riches in an offshore checking account you can avoid the dangers in your brand-new nation such as high rising cost of living, money devaluation or perhaps a coup or battle. For those deportees residing in a country where you just pay tax on the money you remit right into that country, there is an obvious tax benefit to keeping your money in an offshore savings account.

Deportees can take advantage of this no matter where they remain in the globe as it can imply they can access their funds from ATMs or online or over the phone at any kind of time of the day or night, no matter what the moment area. Any type of interest gained is generally paid devoid of the reduction of taxes.

Offshore Account for Beginners

Keep in mind: specialist estate planning guidance needs to be looked for by anybody seeking to benefit from such an advantage. Some offshore financial institutions bill less and some pay even more interest than onshore banks. This is ending up being much less and less the instance nowadays, however it's worth looking closely at what's available when looking for to develop a brand-new overseas financial institution account. offshore account.

Less government treatment in overseas monetary centres can imply that offshore financial institutions are able to offer even more fascinating investment solutions as well as options to their clients. You might profit from having a relationship manager or personal savings account supervisor if you pick a premier or personal overseas checking account. Such a solution is of advantage to those who desire an even more hands-on technique to their account's management from their bank.

Historically financial offshore is arguably riskier than financial onshore. Those onshore in the UK who were influenced in your area by the nationalisation of the financial institution's moms and dad firm in Iceland got complete settlement.

The term 'offshore' has come to be synonymous with unlawful as well as unethical money laundering and also tax obligation evasion activity. Therefore understandably anybody with an offshore savings account might be tarred, by some, with the same brush also though their overseas banking activity is completely reputable (offshore account). You have to pick your pop over to this site overseas jurisdiction carefully.

How Offshore Account can Save You Time, Stress, and Money.

It's essential to look at the terms and also conditions of an offshore financial institution account. It can be more tough to resolve any kind of issues that may emerge with your account if you hold it offshore.

We hope this open and also ever-developing listing of the benefits and downsides of offshore financial will certainly help you to make up your own mind concerning whether an overseas bank account is ideal for you. The Deportee Guide to UK Pensions Abroad what choices you have for your UK pension plan pot when you retire abroad, tax obligation effects of leaving your pension in the UK or transferring it abroad, exactly how you can decrease your tax responsibilities, your UK state pension, etc.Expat Financial Questions Answered By A Specialist Wide Range Supervisor Frequently asked questions about moving to Europe after Brexit: your tax obligation commitments, currency issues, pension plan alternatives, will, estate preparation, savings and investments, as well as, more.Offshore Portfolio Bonds Explained what you require to learn about overseas profile bonds prior to considering them as an investment option.Banking, Saving, & Investments Abroad your financial as well as financial investment options broaden when you end up being a deportee. And also as well as following these robust criteria, expats may still have the ability totake pleasure in more privacy from an overseas financial institution than they can from blog an onshore one. All the time aid if something goes incorrect, with accessibility to telephone and also on-line financial 24 hours a day, 7 days a week, 365 days of the year -usually come as criterion - offshore account. In truth, this reason alone suffices for numerous people to open up an offshore savings account. There can be expat tax advantages to using an overseas bank -however whether these apply in your instance will depend on your personal circumstances, such as nation of house. Also, some account holders that bank in territories like the Island of Guy as well as Jacket, for instance, can choose to get passion on their cost savings find more information free of tax. As an expat, this removes the need to reclaim tax paid, as well as avoids the problem of reconciling your income tax return to guarantee you are not over-paying tax obligation.